Schedule D Irs 2024 – Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. .

Schedule D Irs 2024

Source : m.youtube.com

A bipartisan bill aims to protect journalists from being forced to

Source : www.cnn.com

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

Articles of interest related to business accounting, INTERAC

Source : www.intersoftsystems.com

Tax cap at two percent for 2024 | The River Reporter

Source : riverreporter.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

FinCEN Compliance – Summer 2023 BE 12 Reporting & Beneficial

Source : www.btcpa.net

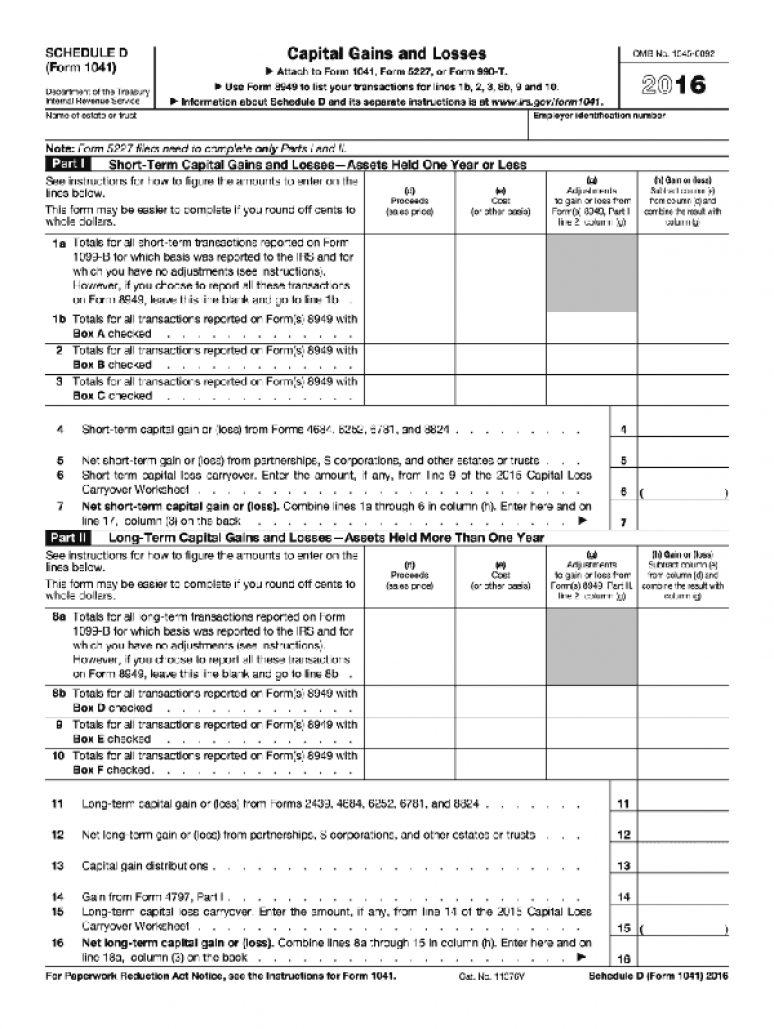

Capital Gains and Losses, IRS Tax Form Schedule D 2016 (Package of

Source : bookstore.gpo.gov

BGFS INC | Riverdale IL

Source : m.facebook.com

The 2024 Cost of living Adjustment Numbers Have Been Released: How

Source : www.yeoandyeo.com

Schedule D Irs 2024 Schedule D Tax Worksheet walkthrough YouTube: There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .