2024 Irs Schedule A Instructions – The Internal Revenue Service (IRS) has revealed new income tax rates for the year 2024, with substantial ramifications for taxpayers. This update affects the way individuals and families will be taxed . Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to .

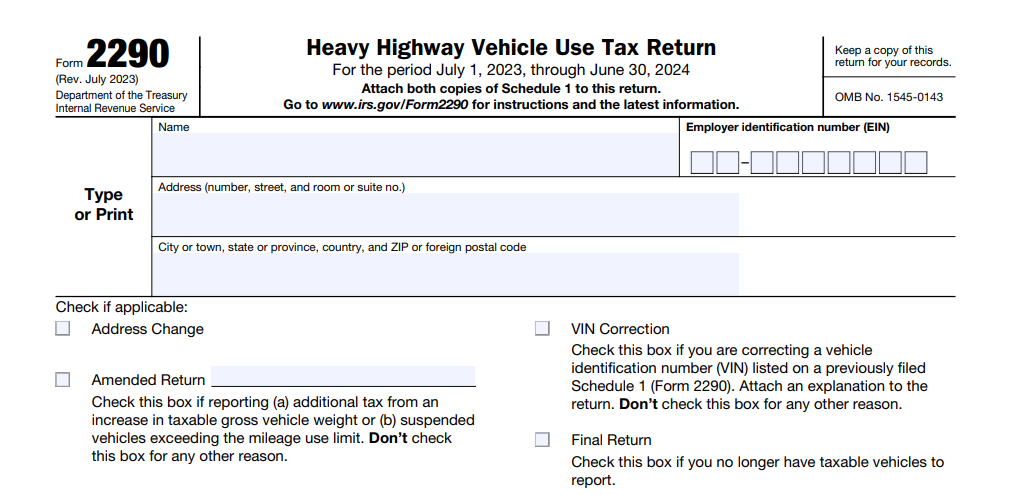

2024 Irs Schedule A Instructions

Source : www.ez2290.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

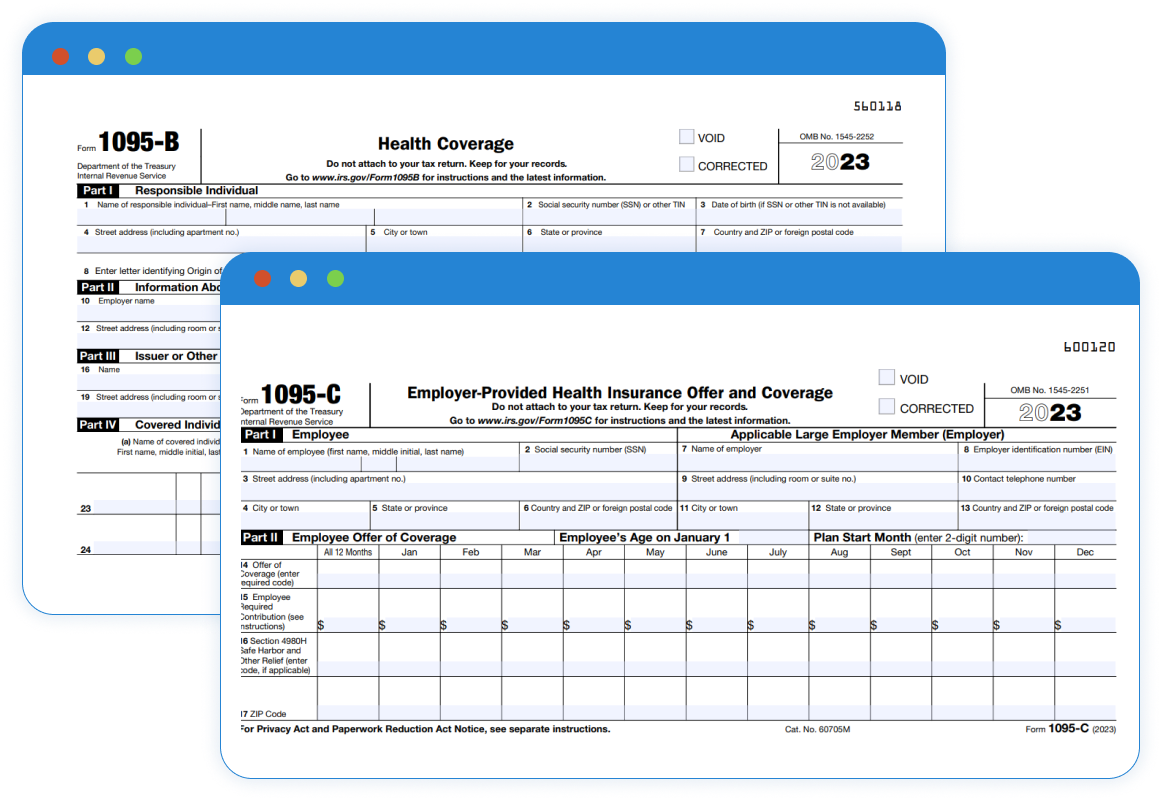

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

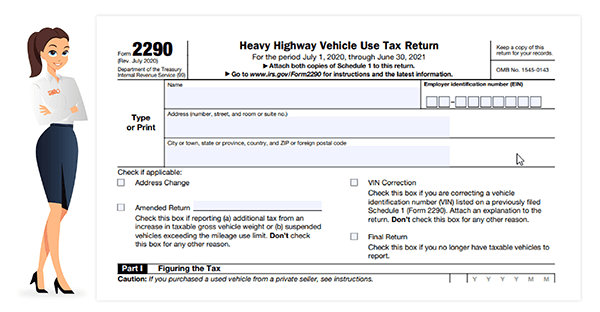

IRS Form 2290 Instructions for Steps to File for 2023 2024 | J. J.

Source : www.2290online.com

The IRS Releases New 1095 Draft Instructions for 2024

Source : blog.acawise.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.com

IRS launches paperless processing initiative for correspondence in

Source : newsismybusiness.com

US IRS 1040 form or US Individual income tax Concept, accountant

Source : www.vecteezy.com

2024 Irs Schedule A Instructions Instructions for IRS Form 2290 | How To File Form 2290 for 2023 2024: The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. . The IRS on Thursday announced higher inflation adjustments for the 2024 tax year, potentially giving Americans a chance to increase their take-home pay next year. The higher limits for the federal .